A compilation engagement (previously referred to as a notice to reader) will be going through some changes this year. This is the first time in over 30 years that the Auditing and Assurance Standards Board has issued a new standard. For those who manage a business and engage a practitioner to compile your financial information, these changes should be taken note of.

What is the New Standard?

A compilation engagement is where a company engages an outside practitioner to prepare and present financial statements. This type of engagement is not designed to express an opinion or provide assurance over the information included in the financial statements. CSRS 4200, Compilation Engagements, will be effective for financial information periods ending on or after December 14, 2021.

What Changes Can be Expected?

The following is a summary of the changes in the new standard. More details on this can be found at CPA Canada:

- The practitioner will ask if the compiled financial information is intended to be used by a third party (i.e. a lender) and whether the third party has access to additional information.

- A discussion about the expected basis of accounting (more details to follow).

- A new engagement letter.

- A discussion on the business and operations, accounting system, and accounting records.

- A discussion about significant judgments that the practitioner has assisted management within the preparation of the compiled financial information (i.e. the allowance for doubtful accounts, the recognition and measurement of revenue).

- Additional discussion may be needed if the practitioner believes the compiled financial information appears misleading.

- Management must acknowledge that it takes responsibility for the final version of the financial information.

- The inclusion of the description of the basis of accounting in the compiled financial information.

- The new compilation engagement report will be attached to the compiled financial information (example to follow).

What is the Basis of Accounting?

The purpose of this additional disclosure is to assist users in understanding how the compiled financial information is prepared. The practitioner may help management select the basis of accounting, but this is ultimately management’s responsibility. Below are some examples of bases of accounting encountered in compilation engagements:

- A cash basis of accounting.

- A cash basis of accounting with selected accruals and accounting estimates.

- A basis of accounting prescribed by a contract or other form of agreement established by a creditor or regulator.

What Will the New Compilation Report Look Like?

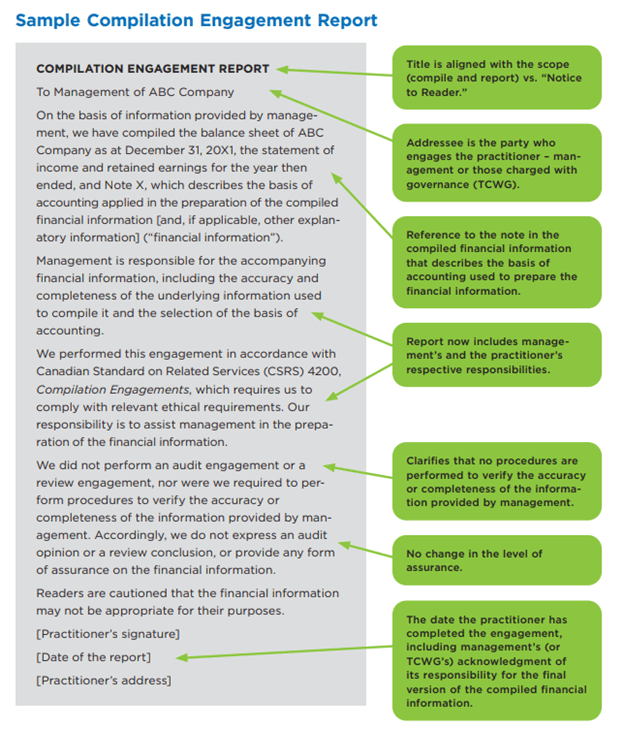

The new report will more clearly describe management’s responsibilities, the responsibilities of the practitioner, and an explanation of the limitations of a compilation engagement. A sample of the new compilation engagement report can be seen below with key points highlighted: